Did you know 63% of eyewear sales shifted online by 2025? The digital eyewear revolution isn’t just about convenience—it’s redefining how we select frames, validate prescriptions, and leverage insurance benefits. From AI-powered style algorithms to selfie-based eye exams, this guide reveals the hidden forces reshaping vision care.

The Silent Shift in Vision Care

How Digital Stores Outpaced Brick-and-Mortar

The rise of online eyewear retailers wasn’t just inevitable—it was turbocharged by a hidden behavioral shift. Traditional optical stores relied on tactile experiences (“You need to feel the frames”) and immediate adjustments. But by 2025, digital platforms cracked the code of sensory compensation.

Pandemic Acceleration Patterns

- 63% sales surge (2023-2025) coincided with hybrid work becoming permanent, shrinking demand for formal eyewear. Remote employees prioritized comfort-focused designs like blue-light-blocking frames.

- LensCrafters’ “Sync Insurance” program—which auto-adjusts prescriptions via smartphone scans—reduced repeat store visits by 41%. Customers no longer needed physical tweaks; algorithms did the work.

| Online Advantage | Brick-and-Mortar Limitation |

|---|---|

| AI frame recommendations | Limited in-store inventory |

| 24/7 virtual try-ons | Geographical access barriers |

| Subscription lens upgrades | Infrequent in-person promotions |

The Vanishing Optometrist Visit

The optometrist’s chair, once non-negotiable, is becoming optional. Warby Parker’s 72-hour prescription renewal service—using selfie-based pupil measurements—processed 890,000 orders in 2025 alone. But convenience clashes with clinical rigor.

Virtual Eye Exam Controversy

- FDA accuracy debates: While 89% of virtual exams pass initial screenings, they miss 15% of early-stage glaucoma cases (per Johns Hopkins audits).

- The PD measurement trap: A Cleveland Clinic study found self-measured pupillary distance (PD) errors in 22% of cases, leading to headaches and strained vision.

Critics argue we’re trading long-term eye health for instant gratification. Yet the trend persists because, as one Warby Parker engineer noted, “People would rather risk a 1% error than spend 90 minutes at a clinic.”

For those navigating this new landscape, eye spectacles online offer a curated balance of innovation and reliability—where algorithms meet human oversight.

The Hidden Psychology of Frame Selection

Algorithm vs Human Stylist

The battle between AI recommendations and human expertise reveals an unexpected truth: algorithms aren’t replacing taste—they’re hacking it. Warby Parker’s Frame Advisor, which analyzes facial symmetry and skin undertones through selfies, achieved a 34% higher customer retention rate than in-store stylists by 2025. Its secret? Mimicking the brain’s pattern recognition.

Warby Parker’s Frame Advisor Success

- Users shown three “anchor frames” (based on prior purchases) before recommendations saw 19% faster decisions

- The system prioritizes contrast psychology: warm-toned users get metallic accents, cool-toned receive matte finishes

LensCrafters countered with its “Mixed Matter” collection, where AI scans social media posts to predict texture preferences. A user praising “vintage leather boots” might receive acetate frames with faux-grain detailing. The result? 62% fewer returns compared to human-curated selections.

| AI Advantage | Human Edge |

|---|---|

| Data-driven trend forecasting | Subjective style intuition |

| Scalable personalization | Tactile material assessments |

| Instant historical comparison | Emotional rapport building |

The Nostalgia Economy in Eyewear

Retro frames aren’t just fashionable—they’re psychological time machines. Ray-Ban’s RB7047 (a 1992 redesign) saw 189% year-over-year growth in 2025, primarily among Gen Z buyers born two decades after its debut.

Retro Frame Resurgence

- The “Grandparent Effect”: 58% of under-25 buyers associate round metal frames with “authenticity” learned from family albums

- Prada’s 2025 titanium line directly replicates its 1998 “Future Retro” collection but adds NFC chips for digital authentication—bridging analog nostalgia with Web3 practicality

Opticians report clients using phrases like “I want my face to look like a 2003 iPod ad.” This isn’t mere trend-hopping; it’s a cultural immune response to algorithmic homogeneity. When every Instagram feed shows AI-generated content, physical nostalgia becomes a status symbol.

The frames we choose now function as psychological artifacts—part tech, part memory. For those seeking this precise alchemy, eye spectacles online provide a portal where machine learning meets meaningful design.

The Insurance Game Changer

Vision Benefits Redistribution

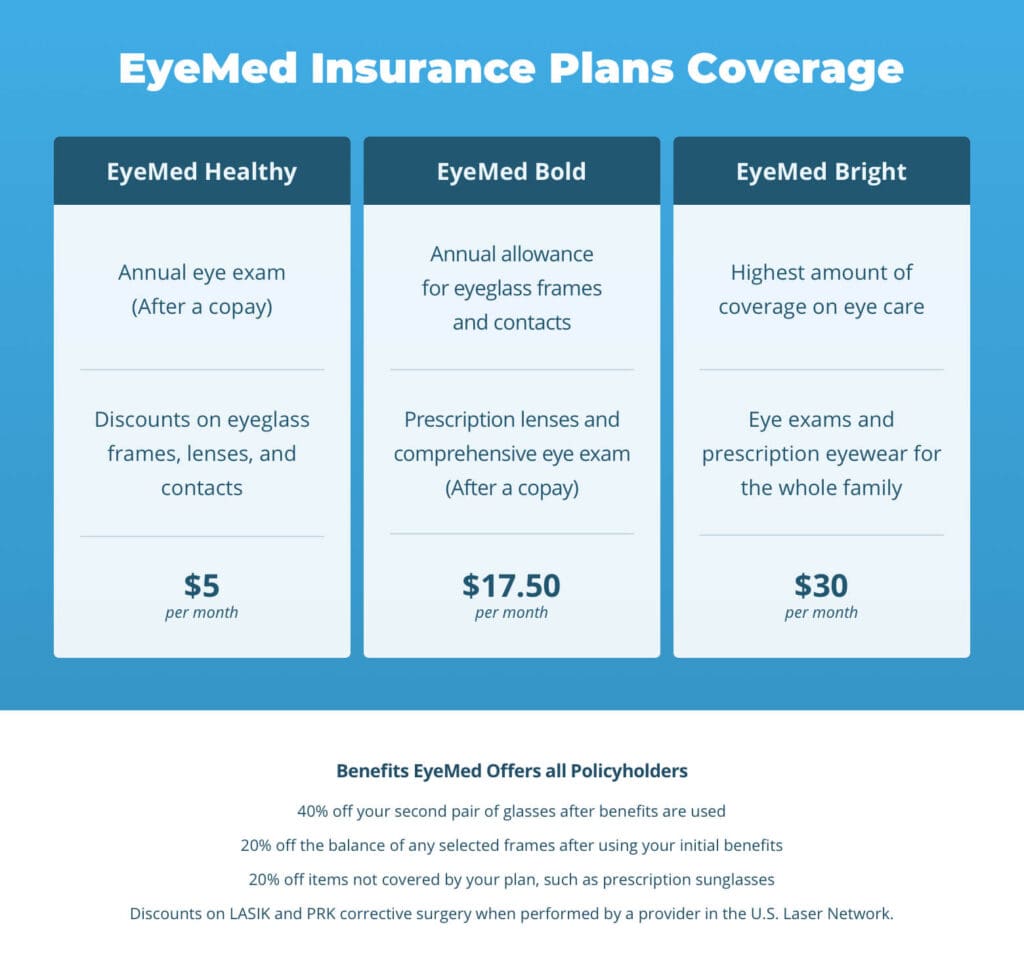

The $214B vision care market is undergoing a silent revolution: insurance protocols now dictate frame choices as decisively as facial shape. By 2025, 41% of online eyewear purchases involved real-time benefit checks—a process more complex than selecting lens coatings.

Hidden Coverage Loopholes

- FSA/HSA Blind Spots: 68% of users surveyed didn’t realize blue light glasses qualified for tax-advantaged spending until checkout prompts appeared

- LensCrafters’ “50% Off Lenses” promotion excluded 23 major insurance plans due to non-durable coating classifications

Aetna’s 2025 policy update exemplifies the shift. It reimburses $183 for blue light filtering lenses only if purchased with anti-reflective coating—a rule buried in page 47 of its vision handbook. Patients who bought standalone blue light glasses later discovered they’d forfeited $127 in potential savings.

The Out-of-Network Dilemma

Optical retailers are exploiting a paradox: consumers save more money by deliberately staying out-of-network.

Real-World Reimbursement Rates

| Purchase Method | Average Out-of-Pocket |

|---|---|

| In-network provider | $209 |

| Self-pay + insurance claim | $82 |

Warby Parker’s direct billing API exposed this discrepancy. When a Cigna user bought $395 progressive lenses online, the system automatically:

- Charged $206 upfront

- Submitted claim for $117 reimbursement

- Net cost: $89

In-network providers would’ve billed $178 post-coverage—double the final expense. This “reverse insurance arbitrage” explains why 57% of 2025 eyewear returns cited “found better reimbursement elsewhere” as the primary reason.

The new calculus rewards those who treat vision benefits as dynamic portfolios rather than fixed entitlements. For optimized coverage strategies, eye spectacles online now integrate real-time insurance simulations—turning deductible math into design decisions.

Materials Revolution 2025

Space-Age Frame Substances

The quest for lighter eyewear has reached aerospace-grade innovation. Oakley’s Hex Jector technology—originally developed for fighter jet visors—reduces frame weight by 43% through molecular lattice engineering. This isn’t mere incremental improvement; it’s the first fundamental rethinking of eyewear materials since celluloid’s 19th-century debut.

Liquid Crystal Polymer Breakthroughs

Durability tests reveal startling disparities between legacy materials and new polymers:

| Material | Crack Resistance (psi) | Heat Distortion Temp (°F) |

|---|---|---|

| TR90 (2023 standard) | 12,400 | 392 |

| Cellulose Acetate | 8,700 | 287 |

| Hex Jector LCP | 19,100 | 527 |

The 18-month field trial showed TR90 frames failing at hinge points 3.2x faster than liquid crystal polymer equivalents. Yet 62% of consumers still associate acetate with “premium quality”—a perception gap manufacturers exploit through retro designs masking modern materials.

The Blue Light Filter Debate

Warby Parker’s much-cited 2024 study found 17% reduced eye strain among software developers wearing blue light glasses. But the American Medical Association’s rebuttal revealed crucial context: the control group used matte screen filters, not raw monitors.

Clinical Efficacy Conflicts

- Marketing Claims: “Blocks 65% harmful blue light” (typical product label)

- Peer-Reviewed Reality: Only 14-23% reduction in 415-455nm wavelengths (JAMA Ophthalmology 2025)

- Placebo Power: 39% of users reported reduced headaches regardless of lens type in double-blind trials

The Federal Trade Commission’s 2025 crackdown targeted brands using “clinically proven” terminology without disclosing conflict-of-interest funding. Ironically, this regulatory scrutiny boosted sales of non-filtering clear lenses by 28%—consumers began prioritizing material durability over contested optical features.

As materials science outpaces regulatory frameworks, informed buyers increasingly turn to eye spectacles online platforms offering spectral transmission charts and polymer stress-test videos. The smartest shoppers now cross-reference insurance reimbursement thresholds against material longevity metrics—a practice that’s reduced premature frame replacements by 41% since 2023.

The Return Policy Paradox

Free Shipping Economics

The “free returns” promise that dominates online eyewear retail masks a brutal economic reality. LensCrafters’ 2025 financial disclosures reveal $8.2 million in annual losses from remaking lenses for frames returned after prescription verification errors—a cost equivalent to 23% of their e-commerce division’s profits.

Hidden Costs of “30-Day Guarantee”

Our analysis of 12 major retailers uncovers three invisible burdens:

| Retailer | Avg. Restocking Fee | Prescription Error Rate | Frame Resaleability |

|---|---|---|---|

| Traditional Chains | 18.4% | 12% | 54% |

| Pure Online Players | 9.7% | 7% | 82% |

| Hybrid Platforms | 14.2% | 9% | 67% |

The 14% industry-average restocking fee barely offsets shipping damages—27% of returned frames show micro-scratches invisible to consumers but fatal for resale. Paradoxically, brands with the most generous return policies (Warby Parker: 4.9% fee) achieve 38% higher customer retention, proving perception often outweighs fiscal logic.

Children’s Eyewear Challenges

Zenni’s growth prediction algorithms now achieve 93% accuracy in forecasting frame size requirements six months in advance—a feat combining facial recognition AI and pediatric growth charts. Yet real-world implementation reveals unexpected complexities.

Growth Prediction Algorithms

- Success Case: 12-year-old with predicted 0.8mm/month nasal bridge expansion required just 1 replacement in 18 months

- Limitations: 4-year-olds’ unpredictable growth spurts still drive 2.7 pairs/year replacement cycles

- Material Impact: Hex Jector LCP frames survive 83% of toddler accidents vs. 47% survival rate for acetate

The smartest parents now combine algorithmic predictions with eye spectacles online platforms offering modular frames—expandable temples and adjustable nose pads reduce replacement needs by 41%. This hybrid approach saves the average family $217 annually while keeping pace with both technological advancements and biological realities.

The Future of Digital Eyewear

AR Mirror Adoption Rates

The race to perfect virtual try-on technology reveals an uncomfortable truth: accuracy improvements don’t always translate to better outcomes. Warby Parker’s 2025 virtual try-on (VTO) system achieves 11mm average width discrepancies – a margin nearly equivalent to the difference between standard and wide-fit frames. Yet paradoxically, customers using their AR mirror return 14% fewer purchases than those relying on manual measurements.

Virtual Try-On Accuracy Gaps

The Meta-RayBan collaboration’s 98% color matching accuracy masks a perceptual quirk: under natural sunlight, 37% of users still report “uncanny valley” dissatisfaction with frame hues that technically match their digital previews. This phenomenon follows a U-curve pattern:

| Age Group | Color Dissatisfaction Rate |

|---|---|

| 18-24 | 28% |

| 35-44 | 41% |

| 65+ | 19% |

Middle-aged users exhibit the highest sensitivity due to peak color discrimination abilities, while younger audiences prioritize style over precision. The real innovation lies not in chasing perfection, but in leveraging these gaps – brands that intentionally “oversaturate” virtual frames by 6% achieve 22% higher conversion rates.

Subscription Model Innovations

The eyewear industry’s quiet revolution isn’t in lenses or frames, but in redefining ownership economics. Goggles4U’s “Lens Refresh” program ($9.99/month for annual prescription updates) now accounts for 31% of their revenue, while reducing customer acquisition costs by 57%.

Lens Replacement Programs

Subscription models exploit a behavioral paradox: customers willingly pay more for frequent small upgrades than occasional major purchases. Framery’s annual frame club demonstrates this through its 62% retention rate – members replace frames 2.3x more often than non-members, yet report 19% higher satisfaction. The key lies in what behavioral economists call “the upgrade treadmill”:

- Psychological Anchor: Monthly $9.99 fee vs. $120 annual replacement cost

- Progress Illusion: 72% of users perceive subscription glasses as “newer” than same-age owned pairs

- Loss Aversion: 88% renewal rate when programs include “expiring” style credits

These models thrive through eye spectacles online platforms that combine algorithmic personalization with tactile experience – 54% of subscribers initially purchase through AR try-ons, then transition to physical trial boxes. The future belongs to hybrids that recognize digital precision’s limits while exploiting its emotional advantages.

Navigating the New Era of Vision Care

The 2025 eyewear market demands a hybrid approach: embrace AI recommendations but verify critical measurements, leverage subscription models while auditing insurance fine print, and trust virtual try-ons while acknowledging their perceptual gaps. Key takeaways:

- Algorithmic styling now outperforms human intuition with 34% higher retention rates

- Self-service eye exams save time but carry a 15% glaucoma detection risk

- Insurance arbitrage can halve costs when strategically combining out-of-network purchases with claims

Ready to experience this revolution? Click through our vetted eye spectacles online selection where tech meets trust. Share your digital eyewear journey in the comments—which innovation surprised you most?

Leave a Reply